Entrepreneurship versus Employment

I was reading an article in the Daily Nation entitled ‘Stop Telling Me To Quit My Job To Start A Business.’ I read through it carefully and noted the points raised.

i. Entrepreneurship calls for a personality type that presents a particular level of aggression which only part of the population has. Moreover, there are people who just do not have the experience or the skill to run a business. Therefore, entrepreneurship should not be sold as the path that everyone should take.

ii. We can’t all be businesswomen; after all, some people really do thrive in employment and gain immense satisfaction from it. Some women enjoy the safe environment that comes from being on someone’s payroll and the freedom it gives them to make and learn from their mistakes without fatal consequences.

iii. Moreover, many employees find that beyond the safety net of a job, there is a vibrant social life to be had from the numerous networks of colleagues. Also, unlike entrepreneurship which often forces you to be a jack of all trades, employment allows you to focus all your energies on your strong points.

Read the full article here. http://www.nation.co.ke/lifestyle/saturday/Stop-telling-me-to-quit-my-job-to-start-a-business-/1216-3441384-13rucdb/index.html

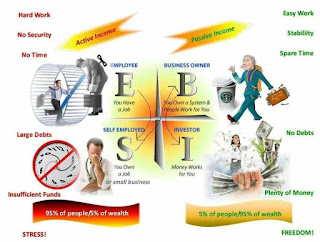

Much as very valid points are raised in the article, this mentality that there are people who are cut out for employment only is the cause of much suffering.

We have millions in their prime of life who are unable to get absorbed into the job market and they are not open to any options outside formal employment.

Some are fresh graduates, others were once in employment but they got retrenched somewhere along the way while others worked throughout their working years and and are now retired, but of course being retired does not mean that one no longer has needs.

It is very sad to see a retiree trying to learn a new trade or to apply for jobs at that advanced age. The end of a job is usually the wake up call that jobs actually don’t last forever.

Kenya is a developing country and salaries are not the highest on the planet. The culture of dependency is also rampant such that many people in employment have countless relatives who are relying on them.

Many people reach retirement when they are not financially stable. It is not rare to come across people who are deep in debt by the time they retire.

The misery that families go through taking care of retired parents or unemployed spouses who can no longer meet their own needs is painful to see. I do not take it for granted that one can easily live 20, 30 years after retiring from employment. Those are many years without an income if employment is all one had.

I am a strong believer in being in charge of one’s finances and I do not believe that anyone should be 100% dependent on a salary for it is rarely adequate plus it will come to an end some day.

Employees are needed in this world and it is impossible for everyone to quit employment to join the entrepreneurship bandwagon.

However, being 100% dependent on a salary and not caring to learn anything else on the side is sitting on a time bomb; it will backfire on you some day and you will not enjoy it.

No one is born into this world knowing anything so there is nothing that some people have the personality that makes them suitable to become entrepreneurs while others are suited to employment. Everyone can build something on the side no matter what their personality is.

It is much safer to explore and learn while in employment, when one still has a regular income rather than waiting to learn in desperation when the job is gone.

Failure to invest in mastering a field outside one’s job is the number one reason why people suffer so much when their jobs end. Many endlessly send their CVs to every possible employer they can think of while others struggle to promote themselves as consultants in the field they are experienced in, often in crowded fields.

Choosing to run a one man’s show (being a consultant) puts one on the path of being overworked, being at risk of being up to one’s neck in debt and having cashflow problems.

Many try to become investors and without experience, chances of losing their hard earned cash are high. Becoming a competent investor requires years of trying, making mistakes, learning from failure and growing.

Other people who are out of job result to small, no good businesses where they work long hours and barely ever make enough.

It takes time and effort to learn how to build something outside one’s profession, but the sacrifice is worth it. As others will be desperate to meet their needs after retirement, you will have something to fall back on.

At the end of the day, it is only the entrepreneurs and investors who get to retire in comfort so it makes sense to learn how to become one of them.

This article is written by Susan Catherine Keter, Website: www.susancatherineketer.com Facebook: https://www.facebook.com/Financial.Literacy.Africa/?pnref=lhc

Financial Independence Africa